First stage fund project to build 300 new homes in NSW

An Australian community housing provider has received the single biggest debt financing facility ever made to a group of its kind as part of a successful affordable housing bid to the NSW government.

Firms: Corrs Chambers Westgarth (St George Community Housing Ltd); MinterEllison (Clean Energy Finance Corporation); Herbert Smith Freehills (NSW Treasury and the Department of Family and Community Services, FACS)

To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

Deal: St George Community Housing Ltd (St George) has entered into a financing agreement with the Clean Energy Finance Corporation (CEFC) to build 300 houses in NSW under the first stage of the state government’s Social and Affordable Housing Fund (SAHF).

Value: A $130 million

Area: Finance

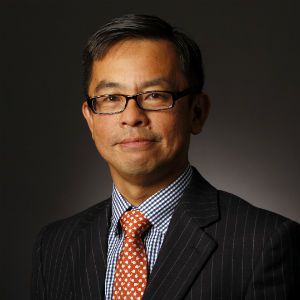

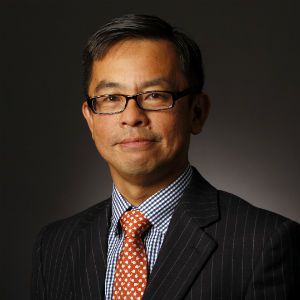

Key players: The Corrs team advising St George was led by partner Andrew Chew (pictured) and Rommel Harding-Farrenberg. Special counsel Megan Russell, senior associate Han Yong, and solicitors Jowa Chan, Jennifer Gamble and Nicole Morris also assisted on the deal.

Minters partner James Mok led the team advising the CEFC on its $130 million financing agreement with St George on the transaction.

HSF advised the NSW state government on five transactions in the first stage of the SAHF.

Deal significance: Community housing provider St George has secured a contract under the first stage of the NSW government’s $1.1 billion SAHF.

Corrs advised the housing provider on financing agreement with CEFC as part of its successful fund bid. The agreement sees CEFC provide another $130 million finance facility on top of an existing $40 million commitment for the financing and construction of 200 new energy-efficient homes.

The latest project will see St George construct 300 community homes in south and south-western Sydney for low-income families.

According to Corrs, CEFC’s combined investment of up to $170 million is the largest single debt finance facility committed to a community housing provider in Australia.

“The SAHF is a key component of the NSW Future Directions for Social Housing in NSW's strategy that will result in more social and affordable housing dwellings linked to tailored support, to help households gain independence,” a Corrs statement said.

“St George’s partnership with CEFC ensures the new homes will be constructed beyond standard building requirements to achieve an average Seven-Star National Housing Energy Rating System (NatHERS) rating. This includes reduced power bills, long-term savings for St George as the landlord, and environmental benefits for the community through a reduced carbon footprint.”

Lead partner advising St George on the deal, Andrew Chew, said the group is delighted to be part of a transaction that provides better outcomes for low-income families.

“St George’s successful proposal is a reflection of their tremendous organisation and all the hard work that went into this process,” Mr Chew said.

St George will also deliver integrated services to tenants of the new buildings, including access to support services for education and employment.