Latin loving

Home to some of the world’s key emerging markets, Latin America presents a growing area of opportunity for foreign fi rms looking beyond China. Briana Everett reports

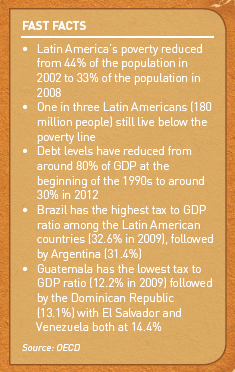

Latin America’s economy is expected to grow by 3.6 per cent in 2012 and 4.2

per cent in 2013, according to the World Bank.

And while it’s still unclear how greatly the current Eurozone debt crisis will impact the region, it is still considered a thriving area of opportunity for law firms.

A region that relies heavily on demand from China, with which trade has more than tripled since the early 2000s, the emerging economies of Latin America survived the global financial crisis and helped pull some of the world’s largest economies out of economic turmoil, albeit with slowed growth in 2011 and 2012 thanks to the more recent global economic slowdown.

As a result of the region’s growing stability in recent years, a number of global firms have set up shop in Latin America, with a significant number of offices being established in the last two years.

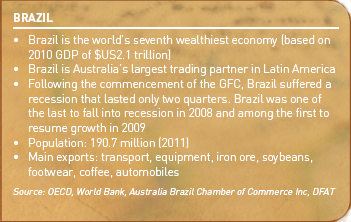

Brazil is the region’s strongest performer and, in 2011, a host of international firms established a presence in São Paulo as part of their Latin American expansion strategies.

This is despite Brazil being highly regulated when it comes to the provision of legal advice by foreign firms.

In July last year, Jones Day opened its second Latin American office in São Paulo, a foreign legal consultancy, following Mexico City.

“Brazil is a dynamic, expanding economy and one of the world’s key emerging markets. It is a significant commodity producer, a world leader in energy, and home to some of the most important worldwide infrastructure projects undertaken in recent years,” said Jones Day managing partner

Stephen Brogan last year.

Also recently spreading its reach in Latin America was DLA Piper, which set up a cooperation agreement with Brazilian firm Campos Mello Advogados in March 2010.

According to the chair of DLA Piper’s Latin America practice, Stuart Berkson, the firm had been eyeing the Brazilian market for several years.

“Simply put, Brazil has a dynamic and growing economy, and it presents a tremendous opportunity

for the firm,” said Berkson when announcing the firm’s new office. Adding to its presence in Brazil, DLA Piper also opened an office in Mexico City in February this year with the help of 14 partners from US firm Thompson & Knight LLP.

The Mexico City office followed the firm’s 2011 opening of offices in Miami and Venezuela.

Other firms to take advantage of the growing economies of Latin America include Norton Rose, through its 2011 merger with Canada_x001F_s Macleod Dixon, and Holman

Other firms to take advantage of the growing economies of Latin America include Norton Rose, through its 2011 merger with Canada_x001F_s Macleod Dixon, and Holman

Fenwick Willan, which set up an office in São Paulo in October 2011 following the acquisition of a team of eight partners from Barlow Lyde & Gilbert (which merged with Clyde & Co one month later).

“If you look at Brazil in particular, I think it’s predicted to become one of the top five countries in the world in the next 10 or 20 years, so it’s definitely emerging,” says Sydney-based Baker & McKenzie energy and resources partner David Ryan.

“A number of people are realising that putting all your eggs in the China basket is perhaps not that smart, and that Latin America is a very big place, particularly from an energy and resources perspective. It’s starting to receive more and more interest.”

Although Baker & McKenzie jumped on the Latin American bandwagon 60 years ago (it opened its first office outside of the United States in Venezuela in 1955), the firm’s Latin America chairman Raymundo Enriquez understands the increased interest in the region over the last couple of years.

“Regardless of the continent, emerging-market to emerging-market work is driving the global economy,” says Enriquez. “The world took notice when emerging markets brought us back from the brink in the recent – and still ongoing – global downturn. We are now starting to see an increasing number of firms arriving in the region.”

According to Enriquez, Baker & McKenzie is seeing an increase in work from large Latin American multinationals seeking to expand in the region and around the world, as well as more Chinese and Japanese clients trying to increase their interests in Latin America.

As to whether Latin America is the next hotspot amid the ‘Asian Century’ hype, DLA Piper’s Berkson says it is already a thriving area of opportunity.

“[Latin America] is already a hotspot, evidenced by the very favourable growth rates in Brazil, Mexico, Columbia and Peru, to name a few,” he says. “Each country in the region has well positioned players in the legal market and competition is significant.”

Protecting Brazil’s own

With a growth rate of 7.5 per cent in 2010, Brazil is clearly the place to be.

And while the country’s growth was hit hard by the debt crisis and slowed growth in China – growing at a much slower rate of 3.4 per cent this year, up slightly from 2011 – it remains a key part of the expansion strategies of global firms.

“The market here is increasingly competitive, with roughly a dozen US or international firms opening new offices [in Brazil] in just the past couple of years,_x001F_ says Clifford Chance São Paulo managing partner Anthony Oldfield.

With economic engagement between Australia and Brazil growing steadily since the 1990s, a growing number of large Australian companies now operate in Brazil, including BHP Billiton and Pacific Hydro.

But despite a desire to follow the work and establish a presence in Brazil, strong regulatory barriers remain for foreign law firms and lawyers hoping to take advantage of the burgeoning economy.

The Brazilian Bar Association stipulates that while foreign lawyers can work in Brazil, they can only do so as foreign law consultants and can only consult in connection with foreign laws, not local laws.

Local advice can only be provided by a local firm which is made up of only local lawyers.

In a similar vein to India, which confirmed last month that foreign law firms and lawyers cannot provide legal advice on foreign law in India, last year the São Paulo chapter of the national bar association confirmed that formal alliances between foreign-trained lawyers and

local lawyers are not allowed.

The issue is now being considered further by the federal bar association.

“For law firms, the barriers for entry are no longer simply regulatory but competitive as well. We have seen this in Asia and parts of Europe already. There are highly-qualified, established local law firms in every jurisdiction,” says Enriquez.

“There will always be an opportunity to represent existing clients on inbound work, but the greatest opportunity in Latin America, as well as in other emerging markets, relies on outbound work.

To tap into that vein, one must invest considerable time on the ground in each jurisdiction, since each

Latin American country has very specific legal settings.”

Given the significant barriers to foreign lawyers in Brazil, the legal recruitment market is not particularly inviting for Australian lawyers.

“Australians are not heard about. Lots of US and European lawyers are applying [for jobs] but not many firms take interest,” says Robert Walters Brazil managing director Frédéric Ronflard. “If they do [show an interest] they want the lawyer to represent the firm abroad and get clients. Meaningful legal work is not done in Brazil by non-Brazilian lawyers.”

According to Ronflard, while Brazil is by far the busiest market, Mexico still has significance. “Mexico is losing importance, however from the point of view of the international law firms it is still the best market – the number of US/UK firms is highest there.

Chile is a very well-educated and growing market,” he says, adding that Argentina is an attractive jurisdiction for firms as they are able to hire a team in Buenos Aires from which they can manage any work in Brazil.

Tapping into Latin America’s resources

The energy, mining and infrastructure industries are key drivers of activity in the Latin American region and continue to pique the interest of companies from developing and developed economies in 2012, including Australia.

“Latin America was not generally a mainstream part of Australian resource companies’ thinking 10 years ago,” says Perth-based King & Wood Mallesons partner Nigel Hunt.

“Together with Africa, Latin American opportunities are now front of mind and there are number of Australian entities with a strong focus on Latin America.”

Noting the risk associated with investing in some Latin American countries due to high regulatory barriers or financial uncertainties, Ryan says it’s becoming an increasingly valuable region from an energy and resources standpoint, and one that is worth the risk.

“Firms decide whether to invest based on regulatory certainty, but in the resources game, you have to balance that up against the fact that resources are in a particular location,” he explains.

“People are willing to take that risk or at least find ways to mitigate the risk of investing in those countries for the sake of some pretty prospective mineral deposits.”

In contrast, Elisabeth Eljuri from Norton Rose Canada says some countries in the region are too

risky to rationalise an investment. “Some of these countries, like Brazil, have important regulatory barriers.

In some cases the market is too small to justify the investment,” she says, referencing Bolivia and Ecuador as examples.

Ryan has also observed an increasing amount of exploration activity in the region, given the low

costs of entry, as well as a number of Australian energy firms establishing a presence in Latin America, such as AGL and Origin Energy.

“There have also been a number of Chinese interests in Latin America,” he says. “They look to places that are more welcoming than perhaps some of the more developed countries are to them.

The Chinese are all through Africa and also Latin America.”

With Brazil hosting the FIFA World Cup in 2014 and the Olympics in 2016, as well as the privatisation of Brazil’s airport, there is a significant amount of infrastructure activity going on in the region.

“Energy, mining and infrastructure will continue to be potent drivers of inbound investment for the

foreseeable future – the next decade or perhaps longer. There is enormous appetite for commodities, including oil, steel, coal and wood, and other supplies coming from Latin America,” says Enriquez.

“Events such as [the World Cup and Olympics] will generate legal work for years to come. On top

of that, interest in the energy and mining sectors is so robust that, in combination with interest in infrastructure and agribusiness, we can safely expect to see the legal market expand over the next five years with sustained growth over 10 years or more.”