Clayton Utz has advised Japan’s Mitsubishi Estate on its complex One Sydney Harbour acquisition.

Firms: Clayton Utz (Mitsubishi Estate)

Value: Undisclosed.

Area: M&A, real estate.

Key players: Clayton Utz brought together a multidisciplinary team to advise on the transaction, which involved complex finance structures and planning regulations.

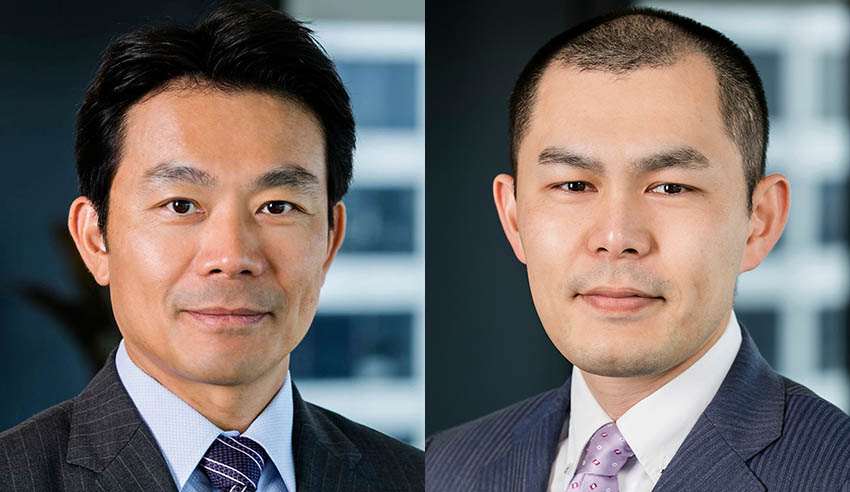

Japan practice group leader and partner Hiroyuki Kano and Japan practice group member and senior associate Masatoshi Suzuki led the Clayton Utz team, which included partners Kathy Santikos (banking), Lina Fischer (major projects), Carrie Rogers (real estate) and Claire Smith (environment and planning).

Other team members were special counsel Tania Chahine and Kate Thomas, senior associates Lauren Smith, Lance Bode and Tanvir Ahmed, and lawyers Leona Zhang and Shaun Chng.

Deal significance: OSH R1 is one of Australia’s most prestigious residential development projects, with 317 residential units expected to generate an estimated $2 billion in sales revenue.

Lendlease said it had agreed to sell a 25 per cent stake of One Sydney Harbour, its under construction 72-storey residential tower in Barangaroo, to Mitsubishi Estate.

Lendlease didn’t disclose the purchase price but said the sale would contribute to about $100 million profit after tax in FY21.

The company said it enters FY21 with gearing expected to be below 10 per cent and total liquidity of more $5 billion, representing cash on hand and undrawn debt facilities.

Mr Kano said the team was pleased to assist Mitsubishi Estate in achieving successful completion of the transaction, notwithstanding the challenging economic environment.

“This was a highly complex deal on which to advise, and involved a truly team effort from our Clayton Utz team who brought together their expertise in corporate/M&A, real estate, financing, environment and planning and projects to navigate the complexities successfully,” he said.

“We congratulate Mitsubishi Estate on its investment, which highlights that there is still [a] strong appetite for Australian assets despite the global economic conditions.”