Victorian owners of electric vehicles successfully persuaded a full bench of the High Court that a tax imposed on the kilometres they travelled was invalid under the Commonwealth Constitution.

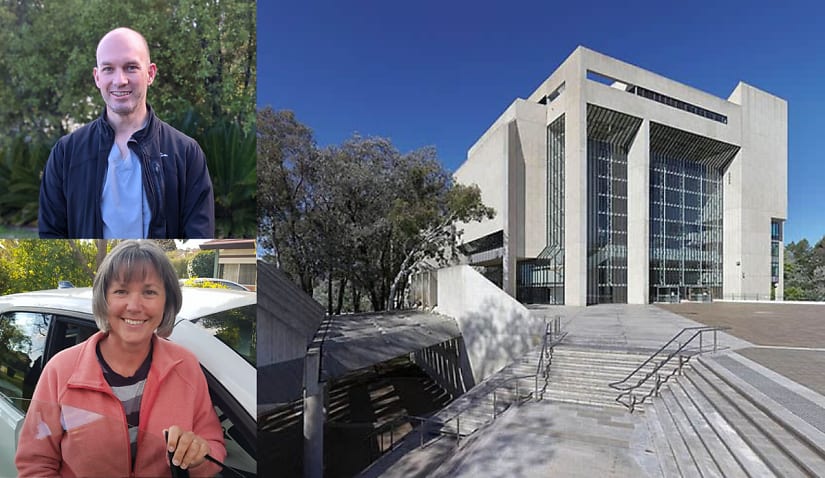

From July 2021, owners like Christopher Vanderstock and Kathleen Davies were required to pay a tax under the Zero and Low Emission Vehicle Distance-based Charge Act 2021 (ZLEV) to the Victorian government based on the time spent on public roads.

Following an argument this tax breached section 90 of the Australian Constitution – which prohibits states from imposing any tax that may be considered to be in a customs duties or excise nature – Chief Justice Susan Kiefel, along with Justices Stephen Gageler and Jacqueline Gleeson, ruled in favour of the electric vehicle owners.

Mr Vanderstock and Ms Davies, represented by Equity Generation Lawyers, had support from the Commonwealth Attorney-General, an intervening party, and the Australian Trucking Association.

The Victorian government, which was also ordered to pay the costs of the proceedings, had the backing of the intervening attorneys-general from the other states and territories.

In its published reasons, the full bench said the last time the court examined the scope and operation of section 90 was in Capital Duplicators v ACT (No 2) and in Ha v NSW.

Held in each case by a majority of four to three, both matters found the constitutional references to “duties of customs and excise” had exhausted the categories of “taxes on goods”.

However, “expressly left undecided” was the question of whether a tax on goods imposed at the stage of consumption, by destruction or use, “similarly answers the description of a duty of excise”.

Also standing in the way of that question was Dickenson’s Arcade v Tasmania, which found a tax on goods was imposed at the stage of consumption but did not answer the description of an excise.

The Victorian government attempted to reopen Capital Duplicators and Ha to argue “for adoption of the view of the minority in each of those cases that duties of excise should be confined to taxes which discriminate against goods manufactured or produced in Australia”.

This was unanimously refused, with the full bench finding that prudential considerations “repeatedly identified as appropriate to be considered” would not justify “now taking the momentous step of unsettling the resultant constitutional doctrine”.

“This is particularly so given that the doctrine bears centrally on Commonwealth-state financial relations, has not since been doubted in any decision of the court, and has now been acted upon by Australian polities for more than 25 years,” the judgment read.

Turning to the treatment of Capital Duplicators and Ha as having settled the proposition of duties of excise as inland taxes on goods, the ultimate question then became “whether ZLEV charge is properly characterised as a duty of excise”.

To answer this, the High Court determined whether the imposition of the ZLEV charge at the stage of consumption takes it outside the scope and, if not, if the charge could be properly characterised as a tax on goods. Respectively, they answered no and yes.

To the extent Dickenson’s Arcade stood in the way of answering the first question, it was reopened and overruled.

“The proposition that a tax on goods imposed at the stage of consumption of goods cannot answer the description of a duty of excise is an anomalous and unsustainable exception to the understanding of the scope and operation of section 90 of the Constitution adopted in Capital Duplicators and Ha,” the bench found.