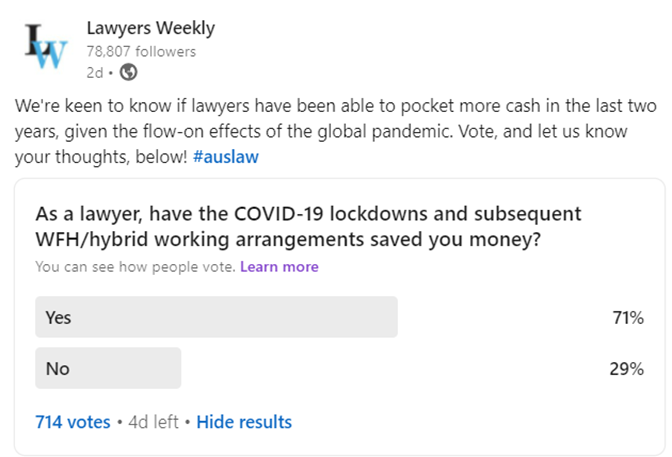

Lawyers Weekly asked the profession whether working from home has been financially rewarding. With almost three-quarters of lawyers agreeing that, yes, it has, savings experts shared tips for maintaining this positive position, while those in the profession mused on what working from home means for employer savings.

A recent Cisco study discovered that 76 per cent of people said they saved money when working from home, with average annual savings of up to US$8,000. Lawyers Weekly was curious to discover if Australia’s legal profession has had a similar experience due to hybrid working and WFH.

To help those in professional services continue this strong saving trend, Lawyers Weekly reached out to law graduate and founder of financial education platform SkilledSmart, Paridhi Jain.

Ms Jain stated: “Something that can be really helpful for people who struggle to keep money saved is to have specific goals for your savings. Without specific savings goals, it can be tempting to spend the money in your savings as it starts to accumulate. When you have specific goals for that money, it’s easier to ward off that temptation by reminding yourself what the purpose of that money is.”

Ms Jain added: “If you’ve been able to increase your savings because of working from home since COVID [sic], now is as good a time as ever to learn about investing. If you have the cash, and you don’t have the skills or know-how it’s very hard to take advantage of opportunities that present themselves. Although saving money is a great first step, investing is really what is going to help you beat inflation long-term.”

Lawyers Weekly also asked money mentor Adele Martin for her thoughts. She said: “If it’s been years since you have looked at your mortgage or energy bills you could be paying a loyalty tax. This is where new customers are getting a better deal than existing customers. Often just by asking you could save money. Five minutes work could make you thousands – that’s a great hourly rate. Think about this compared to the last holiday you booked – you probably spend hours making sure you got the best deal. But a holiday is just a once off saving. A better deal on your mortgage or energy bills can save you thousands every year.

“Whilst it’s important to look at your expenses it’s also important to look at your income. Is there a way you can boost your income? Either through getting your savings working harder for you through investing or making sure you are paid what you are worth. It’s very much an employee market at the moment and with rising cost of living if you haven’t had a pay rise then you have gone backwards in real terms. So do some research and know your worth.”

With the overwhelming majority of Lawyers Weekly poll respondents agreeing with the Cisco study that people are saving money via home working, Lawyers Weekly asked whether employers are also benefiting by saving in this scenario.

In conversation with Lawyers Weekly, Swaab partner Michael Byrnes disclosed his thoughts on where businesses stand financially in terms of people working from home (some or all of the time). Mr Byrnes shared his general observations and noted that they are unrelated to Swaab.

He said: “There are considerable savings employers can make when employees work from home rather than from the office. In fact, a common criticism of WFH is that it transfers some costs from the employer to the employee. That transfer is recognised by tax deductions available to employees for home office expenses. The short to medium term costs that can decrease for employers when employees work from home include utilities (power and water), consumables (such as paper, photocopying, stationery, coffee, tea and fruit) and expenses related to office functions and events (both for staff and clients).”

He added: “If employees embrace working from home then that enables an employer to achieve a significant long term saving by reducing the size of the office and the corresponding leasing costs (which are often broadly calculated on a per square metre basis). It will be interesting to see the extent to which physical workplaces contract in response to the WFH trend. It will be an issue many employers will need to grapple with when the end of lease approaches.”

Mr Brynes noted that productivity for employees that work from home is still being called into question: “There remains a fundamental debate as to the extent to which WFH can affect productivity. Savings achieved need to be balanced against any losses in productivity. Of course, the way clients could still be serviced when there was an enforced WFH period during COVID-19 lockdowns largely dispelled the common assumption that WFH is detrimental to productivity.”

A spokesperson from a national law firm agreed with Mr Byrnes regarding potential savings in terms of “office space”, but there’s a catch. They stated: “The obvious saving would be office space. But most firms are locked into longer term leases and won’t be able to realise those savings anytime soon.”

They added that lawyers don’t seem to be embracing hot desking, and wondered if this might be partly due to concerns (that may dissipate) about contracting COVID-19.

They concluded: “I’m still hearing about firms determining their space requirements on a ‘per head’ basis i.e. x number of employees means we need x number of offices and so on. Obviously there are ways to optimise this usage and there are experts who specialise in this area, but I’m not sure a lot of firms are ready to bite the bullet and use them. I think part of the problem is that once you go down that path, you can’t really go back. You need to make a definite call on what proportion of people you expect to be in the office and from my experience firms don’t necessarily know what the future will look like in this regard.”