Why it pays to verify your client’s identity

Promoted by InfoTrack.

Some recent identity fraud cases and how you and your clients can avoid becoming a statistic

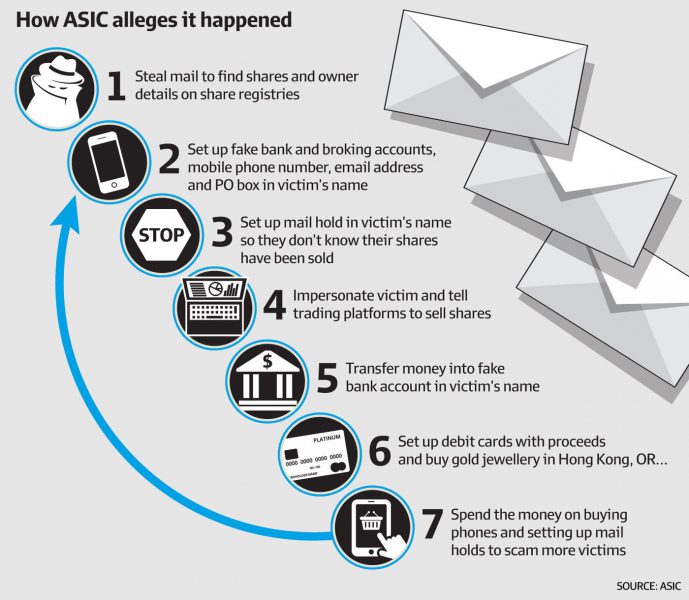

“ASIC alleges Mail theft leads to $4.8m share swindle”. In mid-July, the Australian Financial Review reported that ASIC was investigating a group of people for the identity theft of 33 victims and setting up fake trading and bank accounts to steal $2.44 million in shares. ASIC suspects the money was spread around the syndicate using cryptocurrencies and sent to a gold dealer in Hong Kong.

Unfortunately, this is much more of a common occurrence that we would like to admit. Identity fraud is a serious issue in Australia. Earlier this year, in April, the ACCC reported that Australians lost almost half a billion dollars in 2018. Across the country, there are formalised Verification of Identity(VOI) requirements delivered in an attempt to prevent fraud in property transactions. VOI is not just about complying with regulations, it’s about protecting your firm and your clients. If your firm is exposed to fraud, the implications can include financial loss, reputational damage, regulatory penalties and legal action.

In a recent InfoTrack survey, almost 50% of practitioners admitted they still photocopy their client’s identity documents, while 23% send their clients to the post office, 19% use an online VOI tool and 8% arrange VOI through an agent. Many practitioners are likely continuing with the manual method of verification out of habit. However, as more of the conveyancing process becomes digital, it's important to consider how you can improve not only the efficiency, but the security of your VOI processes.

InfoTrack’s online VOI solution, WebVOI, provides extra due diligence measures for verification, along with flexibility with how you verify. WebVOI enables you three ways to verify.WebVOI provides you with flexibility based on your availability and your client’s location. You can choose any option:

1. In person

If your client is coming into your office, you can complete the VOI with them in a few minutes. Simply take pictures of them and their identity documents and submit for processing.

2. DIY

If your client is unable to attend your office because they live remotely, you can initiate a DIY VOI that will send them a link an enable them to submit the necessary proof of identity.

3.External Agent

You can now send your client to the InfoTrack Settlement Rooms in Sydney or Melbourne and have one of our agents complete the VOI.

Regardless of which method you choose, WebVOI runs additional checks in the background help enhance your due diligence and give you greater peace of mind when it comes to VOI. Our aim is to provide you with an online verification tool that not only integrates with your practice management system but also provides additional layers of verification.

Three layers of verification

WebVOI is powered by InfoCheck which provides three additional verification measures. InfoCheck runs the documents through the following processes:

- Document Verification Service (DVS)

DVS is a national online system operated by the Australian Government that compares identity information with government records – it confirms details on a provided document match records held by the government authority that issued it and checks if the details are still valid. Click here for more information on DVS.

- Facial Recognition

Our facial recognition technology uses deep learning algorithms to detect facial patterns and match images regardless of angle, posture, lighting, facial hair or whether the user is wearing glasses. We complete a direct comparison between the government certified image (for example a driver’s licence or passport) and the self-taken photo to verify authenticity. - Optical Character Recognition (OCR)

OCR detects text within an image, identifies the language and extracts the text. That means it lifts details directly from ID documents to pre-populate the VOI and your matter. This increases the accuracy of identity information, avoids manual data entry errors and saves time.

Once the documents have been checked against third-party sources through InfoCheck, the report will come back with results for each document of either ‘Verified’ or ‘Could not be verified’. If any documents cannot be verified by InfoCheck, you can take any additional steps you deem necessary to verify the client’s identity.

Ensuring that your client is who they say they are is key to protecting your client and the reputation of your firm. To find out more about using smart technology to strengthen your verification of identity processes, click here.

About InfoTrack

InfoTrack is the leading innovator in legal technology. We provide an integrated platform that enables our clients to find, analyse, organise and communicate information efficiently and effectively. InfoTrack has been at the forefront helping businesses through technology innovation for over 19 years and has a deep understanding of the legal conveyancing industry with over 8,000 legal clients across Australia.