Promoted by LodgeX Legal

We have a solution for you to get more out of administrative and junior staff, to get the best out of your team.

We have a solution for you to get more out of administrative and junior staff, to get the best out of your team.

It seems like conveyancing is getting more and more complicated, with fewer professionals who are appropriately qualified and trained and capable of managing complex matters. With each new system, process or regulation that is introduced it feels that another professional leaves the industry. And with less courses available and a tight job market, replacing those members of your team can prove a real challenge. And it’s not just professionals leaving the industry all together that creates tension for businesses, sometimes it’s something as simple as staff looking to take leave, coming down with COVID or the flu, or undertaking care responsibilities, suddenly leaving your business with a temporary hole and few options to fill it. Take a deep breath, because there are options. We are going to break down the conveyancing process, and identify areas in which you can save time, money and sanity, enabling you to undertake more work using the same resources you already have available to you.

Some of the biggest barriers to efficiency in conveyancing come from two areas: repetitive, administrative processes attached to a transaction, or, high-level authoritative tasks which require specialist staff by law for completion & compliance checking. These two areas require different levels of professional training, qualification and expertise, but what if you could minimise both of them with one solution? Let’s look at a case study, using solutions provided by LodgeX Lapp.

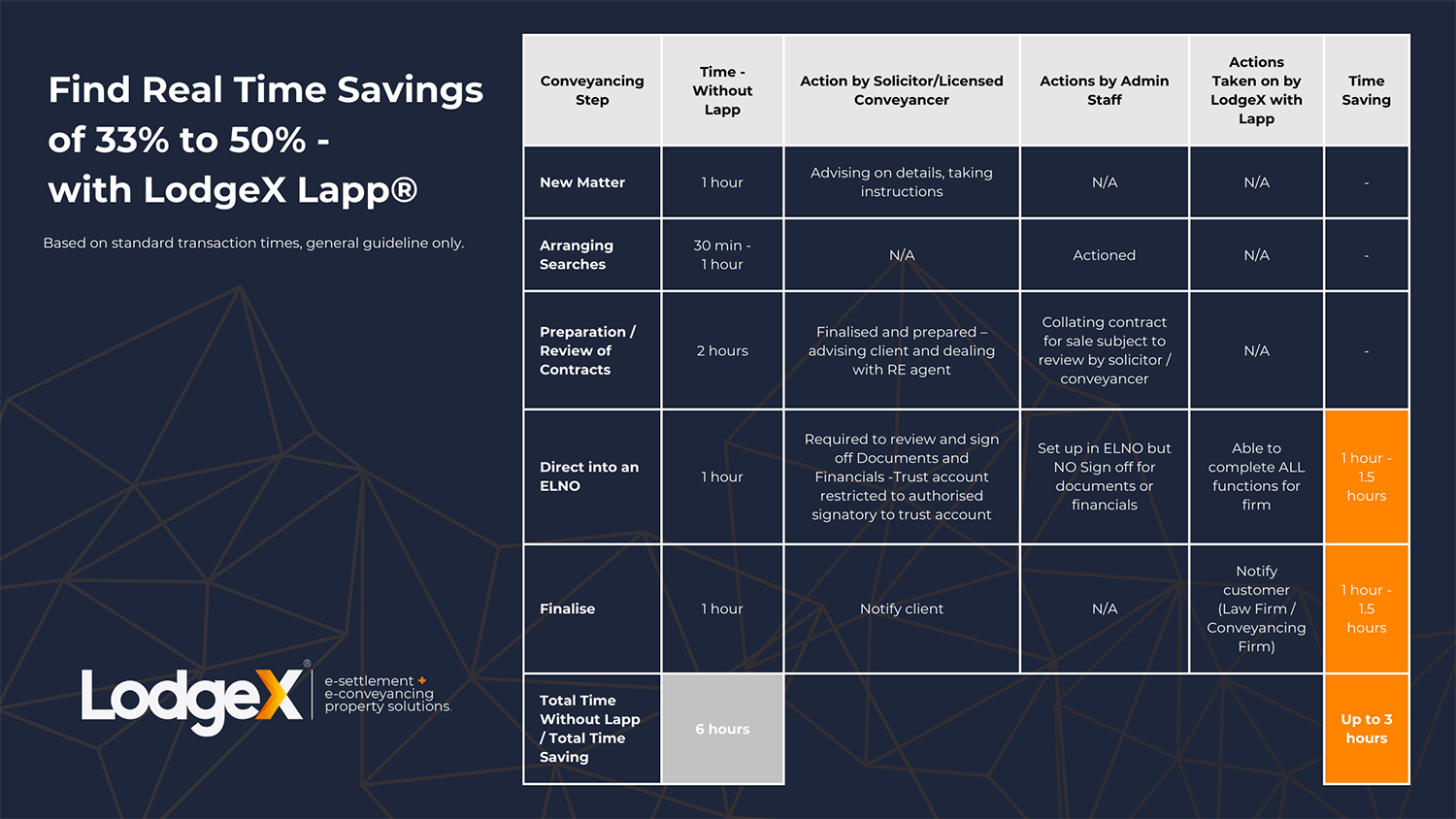

The current process to a conveyance goes something like this:

These steps all take up valuable time for a net-zero income result to the firm. The costs of complying with the regulatory requirements in the workspace must be incorporated into the overall-fees for the conveyance. In other words, these costs are absorbed as part of the work necessarily completed in the matter. This work is not advisory, it gives no added tangible benefit to the client, and is effectively an operational cost to your business. How do you reduce these operational costs while still delivering the best service to your client?

This is where LodgeX steps in.

By operating as an extra arm to your team, these questions can be answered through the process we developed through our platform, Lapp. Check out this case study of time you could be saving by running your transactions through Lapp with our team working alongside yours.

LodgeX Lapp is our solution to saving your firm time and money, and maximising the efficiency of your staff by unlocking greater potential in your administrative or junior staff. As LodgeX completes the work in the workspace, there is no requirement that the instructions are inputted into Lapp by a solicitor or licensed conveyancer. A well-trained junior or admin support staff member can easily input the data required to generate a Lapp file. This enables the practice to better utilise its support staff and also empowers staff to learn, providing a valuable training ground for those junior staff wanting to learn more about conveyancing. There is no requirement for a partner, lawyer or conveyancer to review, verify, approve and sign off on documents, financial items, as this is all done by LodgeX in Lapp with full visibility so you have up to date real time updates on the progress of your matter. You have more opportunity to employ junior staff and provide those with aptitude and keenness to learn conveyancing with exposure without needing to first ensure they have a full licence to undertake any part of the process. On top of all that, LodgeX Lapp fees are fully recoverable as a disbursement so a net zero cost for your practice.

Want to see how you can unlock greater potential from your firm and resources? Sign up now to complete your first transaction with LodgeX Lapp, and experience a new way to do conveyancing for your firm.