On 12 October 2021, the Windfall Gains Tax and State Taxation and Other Acts Further Amendment Bill 2021 was introduced into the Victorian Parliament. If enacted, this would introduce a Windfall Gains Tax (WGT) on the extra value added to your property as a result of rezoning, writes Russell Krupp.

As the bill is not yet law, it is subject to change before being enacted. However, to prepare you and your clients for what’s likely to come into effect, we have outlined what you can expect and how this will likely impact these clients.

The rate is 62.5 per cent of the difference in the capital improved value of the land before and after the rezoning (uplift) that exceeds $100,000. Because of the tax-free threshold that applies under this rate, the effective tax rate is less than 50 per cent.

Where the taxable value uplift is $500,000 or more, the rate of WGT is a flat 50 per cent of the uplift.

Multiple landowners are jointly assessed for WGT without regard to the separate interest of each owner.

Does this apply to my clients?

The WGT is intended to commence on 1 July 2023. Rezonings that were underway prior to 15 May 2021 will escape the WGT.

There is a threshold of $100,000 (available once per owner or group of owners for rezonings under the same planning scheme amendment).

Up to two hectares of residential land (including primary production land with a residence) will also receive an exemption from WGT.

Affected landowners can defer payment of up to 100 per cent of the tax for up to 30 years or until a dutiable transaction, whichever occurs first; however, interest will accrue on the deferred WGT. Very broadly, the interest rate is the average daily yield for the 10-year TCV Bond Rate for May of the preceding financial year.

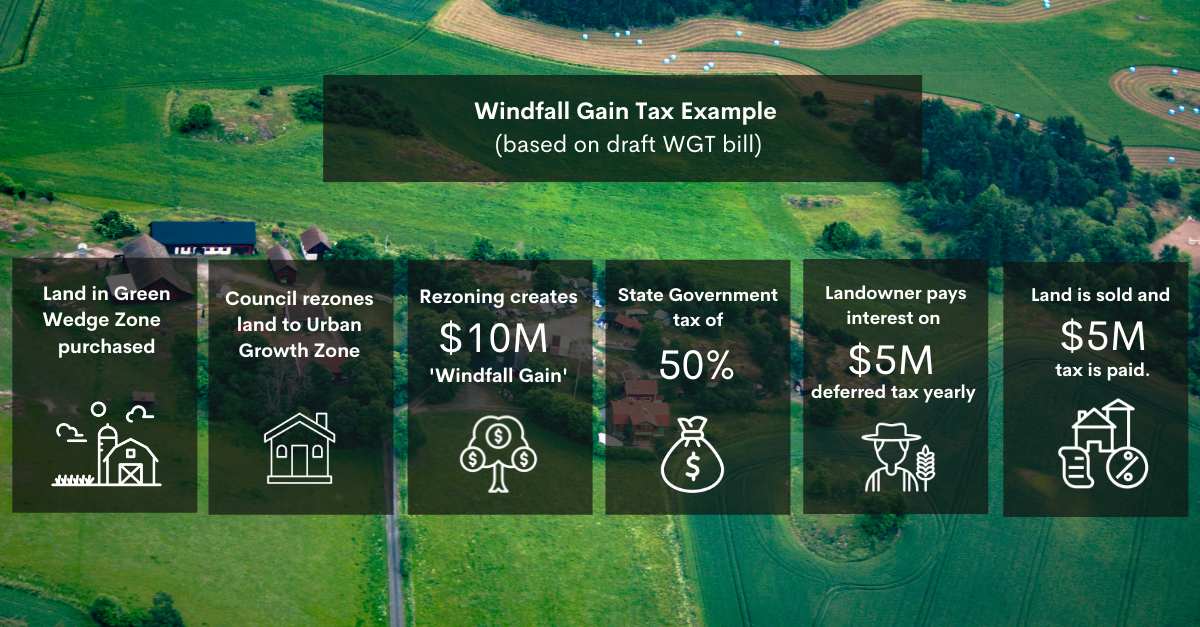

An Example (based on the draft WGT bill, which is subject to change)

Frank and Estelle Constanza acquired a block of land in the western suburbs of Melbourne in the early 80s. The land has a total area of 12 hectares. Frank and Estelle use the holiday house and hobby farm on the land (comprising two hectares of the total area of the land) primarily for residential purposes.

As a result of a review commenced in the 2024 year, Melton City Council determined that the available greenfield land supply was below requirements. Accordingly, the council rezoned the land from Green Wedge Zone to Urban Growth Zone. As a consequence, the land increased substantially in value. This is the only land owned by Frank and Estelle that is affected by the rezoning.

The gross uplift in value of the land for WGT purposes was $12,000,000. The uplift attributable to the residential land was $2,000,000. Accordingly, the taxable uplift for WGT purposes is $10,000,000.

Frank and Estelle will be jointly assessed for WGT of $10,000,000 x 50 per cent = $5,000,000 as if a single person owned the land.

Frank and Estelle make an election in the approved form to the Commissioner of State Revenue for Victoria to defer payment of 100 per cent of the WGT.

On 1 July 2034, Frank and Estelle sold the land. Frank and Estelle must pay the deferred WGT and interest within 30 days of the settlement of the land sale.

Final thoughts

With Victoria’s borrowing now the highest in the country, it’s clear that the temptation to participate in Melbourne’s seemingly endless property boom has clearly become overwhelming.

Some argue that this will create yet more upward pressure on property prices. Others note that it is fair and economically efficient for Victorians as a whole to benefit from rights to develop land, rather than concentrating these windfalls in the hands of a few landowners and developers.

Russell Krupp is special counsel at Morrows Legal. He is a chartered accountant, lawyer, and an accredited specialist in tax law with the Law Institute of Victoria (LIV), one of only 10 accredited in Victoria.