Despite all the fights I have had with WorkCover Queensland, on behalf of clients and all of the “missteps” by claims representatives in the management of injured workers’ claims, I must concede – Queensland has the best workers’ compensation scheme in the country, writes Travis Schultz.

I am always sceptical about the flange-flowery language and ambitious claims that we see in annual reports – and the WorkCover Queensland Annual Report is no different. Its stated vision is “to be the best workers’ compensation insurer and make a positive difference to people’s lives”, which sounds rather aspirational, but when you drill down into the numbers, there is little doubt that Queenslanders owe a debt of gratitude to the architects of our workers’ compensation scheme.

As an employer, I am always acutely aware of the costs of doing business, and like everyone else, begrudge government taxes, levies, and imposts. But when I researched the schemes of other jurisdictions, it is clear that we are lucky to be Queenslanders!

Quite apart from the scandals that have rocked workers’ compensation schemes in other states – such as the icare scandal in NSW, where underpayment of statutory entitlements could be as high as $40 million – the key performance indicators of the cost of premiums and funding ratios (which show the liquidity of the scheme) clearly put Queensland ahead of the pack.

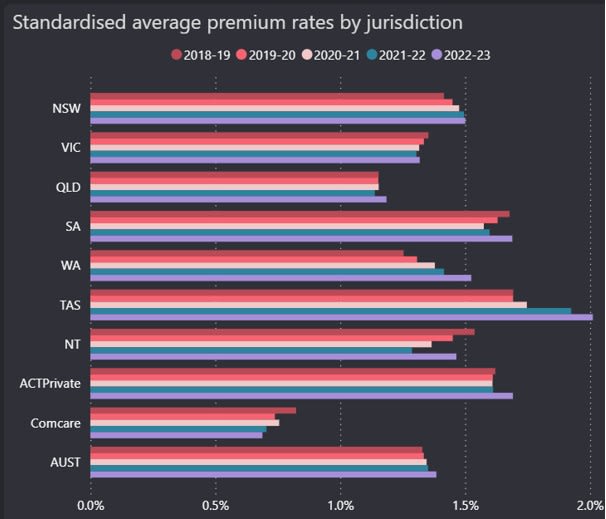

Safe Work Australia publishes a bi-annual comparison report, looking at the key performance metrics of all the workers’ compensation schemes. While the 2025 report has not yet landed, the 2023 report tells the story. When it comes to premiums, Queensland’s premium as a percentage of payroll is the lowest of any state, that is despite key benefits of the Queensland scheme, including access to common law damages and cover for journey claims to and from work and during recesses. These are not all features of every scheme.

The Safe Work report contains the following table to premiums:

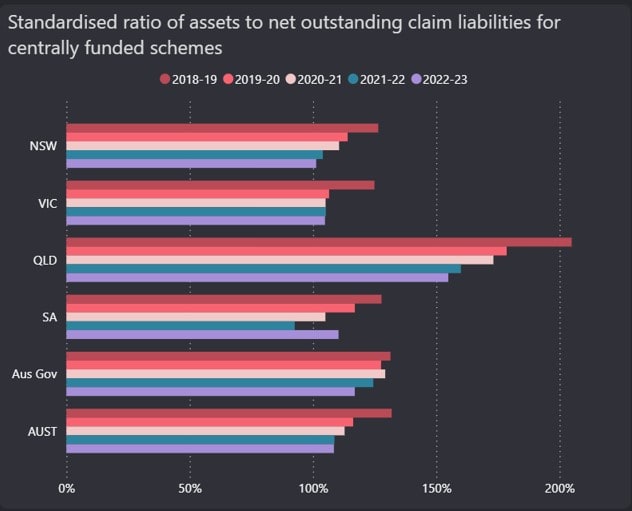

When it comes to the liquidity of the scheme – which shows scheme assets, compared to outstanding liabilities, Queensland is miles ahead of other jurisdictions. The graph of this from the Safe Work website is as follows:

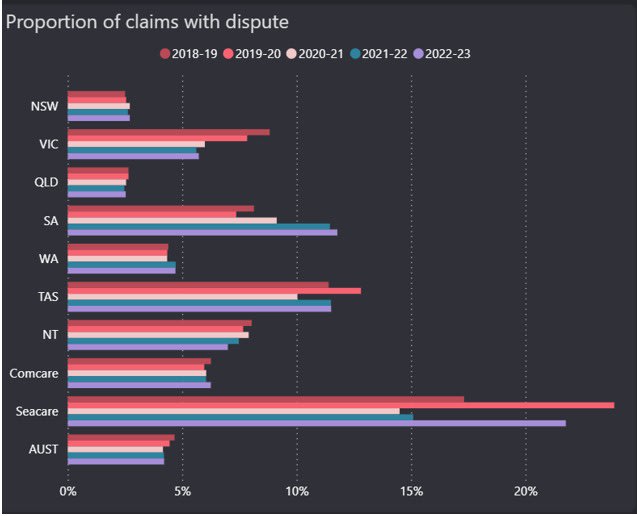

From the perspective of injured workers, dispute rates are important. These are the frequency with which the insurer disputes a claim and refuses to pay. Once again, Queensland is well ahead of its peers. Here is the data:

There is no doubt that every government scheme needs continuous improvement, and arguably, some tinkering of the rules around psychological injury claims might need to be considered to find a balance between the interests of workers and employers. To keep any scheme strong, it needs to be well-regulated and compliance-monitored – including the rare, but nonetheless concerning, incidents of worker fraud. So too, do we need claims management practices to be robust and ethical?

So, it seems that I owe WorkCover an apology. I take back some of those criticisms I have made from time to time about “stupid decisions” and being a “mean-spirited insurer”. We can probably forgive the alleged incentivisation of claims managers to end workers’ claims. The numbers don’t lie – you guys are doing a much better job than your counterparts in the rest of the country!

Travis Schultz is the managing partner of Travis Schultz & Partners.