Firm leaders, particularly those in the SME space, have to be prepared to manage the fallout of global events, writes Jacob Aldridge.

The sudden collapse of global share markets, supply chains, and consumer confidence linked to the COVID-19 outbreak risks creating the fastest economic downturn and first Australia recession in three decades. Law firm partners, particularly managing partners and those who own boutique firms, must respond now to reduce their fallout.

At the time of writing there are 112 confirmed COVID-19 cases in Australia, the All Ordinaries is down 19.5 per cent, and there are five clear actions that leading practice managers must take.

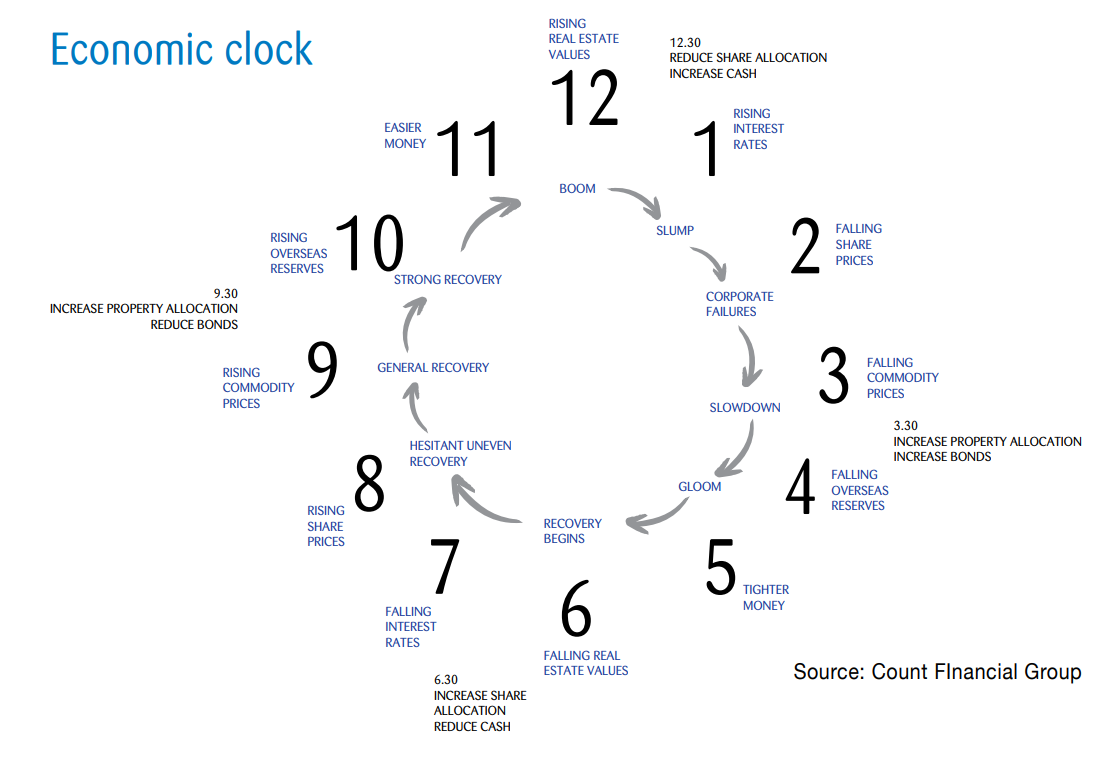

Understand the economic clock

Our economy moves in a cycle, which can be represented by a clock face (see diagram) but unfortunately does not advance as predictably. While nobody thinks good times will last forever, the overreaction when they end makes it appear that a downturn is more permanent.

This framework is a valuable tool for understanding and communicating with your team and your clients. Depending on “what time it is”, we may only be at the beginning of the downturn with more pain to follow. Aspects of this are outside our control, while other parts are predictable.

How are your employees and clients going to react in the coming months? Fear and uncertainty are increasing, which is why demonstrating your calmness and leadership is vital. Right now, you may not have all the answers, but you can make it clear to your team that you are asking the right questions and not ignoring what they see on the evening news.

It is also vital to note that different sectors move in different cycles. Insolvency law may be on the cusp of a boom, as too may be corporate or ER firms with clients forced into major restructures.

Keep communicating

Never is the adage “No news is good news” falser than during tough economic conditions.

Leaders hoping to avoid fear often feel that when they have no news, they have nothing to say, and when the news is bad, they don’t want it said.

But over-communication is critical to strong leadership. Even a “nothing has changed” update to your team is better than the assumptions and fear that can fill your silence.

When did you last review your internal communication strategy? One example of a bold approach is a weekly, all staff, “ask me anything” meeting with the managing partner. This creates a clear and open dialogue with your whole business, and while it may be premature today it does more to assuage concerns than a carefully wordsmithed email.

Cash is king

The cash flow cycle in business can grind nearly to a halt during the worst of an economic downturn, and so right now is the time to ensure your processes are strong to see you through.

Most firms have months’ worth of cash sitting in WIP and debtors. As the economic clock approaches 5:00, both will balloon. Your team will be told to “slow walk” matters to maintain the illusion of being busy and therefore gainfully employed. Your clients will begin treating you like an interest-free bank loan.

Without needing to alarm anybody, ensure your managers are focused on completing matters and sending bills even when there is money in trust. You may need to increase your customer service activities to ensure prompt payment – a phone call with every invoice requires time now, but may save you hours of chasing the bill later.

New business and the client journey

Most recessions are short and sharp. The flow of money in an economy slows, but pent-up demand never ceases and we rebound as quickly as we collapsed.

The GFC was different, because the flow of money broadly stopped, thereby changing the shape of the recovery. It is highly unlikely Australia will experience “another GFC”, but your individual practice might if the flow of new clients and matters suddenly stops.

“New business” is not the best answer at this point on the economic clock, because increased sales activity now will still take six months or more to turn into cash.

However, it is part of the solution, and you need to ensure that your partners or marketing team don’t decide the world is ending so business development activity is no longer a priority.

Providing additional love to your existing clients as they journey through your business is also crucial. Touchpoints that used to be skipped must now be reintroduced to prevent matters from being stalled or withdrawn by clients who are uncertain about progress and seeking to save cash themselves.

Engage your network and advisers

It takes a village to lead a business through a recession. As you seek to project confidence and leadership, having peers with whom you can share your natural fears is invaluable.

For larger firms this may be a steering committee; for boutique law firm owners, informal networks and groups such as The Happy Lawyer, Happy Life Club can become part of your weekly energy management.

Ensure also that you have the right team of advisers around you, people who can clearly see how your business life cycle overlaps with the economic cycle to create unique challenges or opportunities. Have a CFO – even a part-time CFO – to guide your cash flow, and any other cultural, communication, or leadership support you may require.

For the coming year, there’s more to surviving than washing your hands and working from home. Where other leaders will react to uncertainty, now is the opportunity for you to lead with strength.

Jacob Aldridge is an international business adviser and keynote speaker on the impact of economic cycles on small and medium enterprises.

Jerome Doraisamy is the managing editor of professional services (including Lawyers Weekly, HR Leader, Accountants Daily, and Accounting Times). He is also the author of The Wellness Doctrines book series, an admitted solicitor in New South Wales, and a board director of the Minds Count Foundation.

You can email Jerome at: